Contents:

The ultimate goal is to create an accurate and factual financial statement for a specific period of time, to show the company’s financial health for the statement period. Your business needs financial reporting for compliance, making sure the numbers are adding up and to prevent cash flow problems. You also need management reporting so you can make better business decisions backed by solid data. Analyzing and understanding financial statements is key when a business needs to make an important decision. Financial reports allow management to identify trends, potential roadblocks, and actively track their financial performance in real-time.

Government’s consolidated financial statements included in the Financial Report and, therefore, GAO disclaimed an opinion on such statements. Financial reports for private and public companies based in the U.S. must follow the Generally Accepted Accounting Principles , while most international companies report under the Internal Reporting Financial Standards . While both accounting frameworks provide standard rules and guidelines, there are slight differences between the two financial reporting systems. To make cash flow estimates, companies should use historical financial statements.

Additionally, they are often used as marketing material for employees, customers and the company’s community of business partners. There are several searchable, commercial online repositories to help find annual reports, but they can also be found directly on most companies’ websites. Digital annual reports are designed to reflect a company’s brand and be interactive, combining financial data with playful illustrations, video and audio. For example, an athletic sports brand used chart generators and animation in its online annual report, earning it awards. A balance sheet provides a snapshot of an organization’s financial health at a particular point in time. Balance sheets help a business determine its true net worth because they lay out the assets , liabilities , and shareholder equity/owner’s equity .

- You also need management reporting so you can make better business decisions backed by solid data.

- Last but not least, the cash flow statement portrays how much money entered and left the business during a particular time period.

- Keeping your budget expectations and proposals as accurate and realistic as possible is critical to your company’s growth, which makes this metric an essential part of any business’s reporting toolkit.

Each revenue account will list every agency that has had collections for that revenue account. Revenue Status Report from Cardinal – sorted by Business Unit , Fund, and Account. 27 The 22 entities include HHS, which received an unmodified (“clean”) opinion on all statements except the SOSI and the SCSIA. Appendix D defines requirements for determining compliance with the FFMIA that are intended to reduce the cost, risk, and complexity of financial system modernizations. The website is no longer updated and links to external websites and some internal pages may not work.

Combine transactional, operational, benchmark, and planning data to get a complete view of the business. Professional Services AutomationProject and resource management, billing, time tracking, expenses, and more. Analytics and ReportingFinancial, workforce, and operational analytics; benchmarking; and data management. Regardless of the Accounting Period selected in either the Criteria Page or the Criteria Frame, the report data will always be as of the current month .

What is Management Reporting?

This is an important example of a role-based financial dashboard and is one that summarizes the key data required by the most senior financial officer. Typical reporting on a CFO dashboard might be working capital KPIs, accounts receivable and accounts payable turnover, credit utilization, payroll data and budget trending, as well as summary financial statements. Financial reporting provides insight and transparency into a company’s financial position and its operations. It’s meant to give stakeholders in the company the right information, in the right amount of detail, to make better-informed decisions. This is true, whether for an external investor, a taxing agency or internal management.

GAO Audit Finds Serious Issues in Financial Management – The WasteWatcher

GAO Audit Finds Serious Issues in Financial Management.

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

Having an insight into the 6 steps to migrate to the cloud financial situation of your business is important to each high-ranking member of the company . Understanding how your business is performing from a financial standpoint can seem like an impossible task without these reports. NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. They can have a significant impact on a public company’s stock price, since they may signal significant trends, for good or bad.

Office of Policy and Management

Open and complete access to a company’s financial data helps build trust and solidify relationships with the business. This is because departments, teams, and business leaders at all levels rely on current financial data to make decisions, plan budgets, and track results. Also, these financial statements are typically the starting point from which to begin assessing how finance teams can communicate with their business partners. Finance communication and alignment and the ability to turn complexity into clear statements is key to improving the role of Finance as a business partner. Financial statements can translate into business understanding, connection, and action.

The information communicated in financial statements is what investors rely on when they are assessing risks, profitability, and future returns. Finance professionals need to be prepared to answer a wide array of questions regarding business data, and with Datarails they can be. Finance professionals can bring management reports to life by drilling down and filtering through graphs and charts directly in the PowerPoint deck.

This is why we still mention them and provide examples of what can be tracked and analyzed every day, but for a long-term view, you should take a look at our annual, weekly, and monthly reports. The monthly ones are on top illustrated with beautiful data visualizations that provide a better understanding of the metrics tracked. Employees submit reports to their managers, who then use those reports to inform executive management of progress and make strategic decisions. We understand the complex challenges that the Office of the CFO faces and translate that knowledge into intuitive, enterprise-scale CCH Tagetik performance management software solutions.

GL Accounts: What Are They and How Do They Work in Double-Entry Accounting

Financial accounting includes routine tasks like tracking accounts receivable balances and creating invoices, which is part of building financial reports. Corporations also typically publish a written annual report once a year that addresses the financial condition of the company. As part of this report, the president or chief executive can include a narrative management financial report that discusses and highlights the numerical results presented in the accompanying financial statements. This update to the shareholders is similar to management’s update to the board, except it is always in writing.

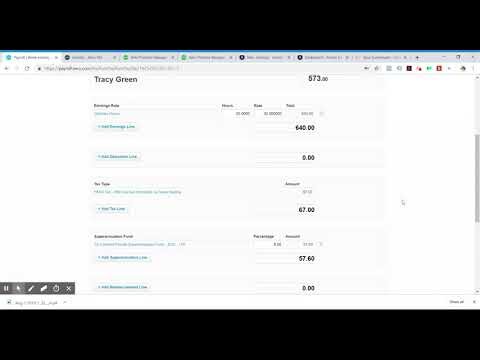

To gain valuable insight into the sales and expenses that incur in your business, you can use the QuickBooks Profit and Loss Overview Dashboard. You know that you have found a breakeven point if your business expenses are in line with the sales volume. Use a specific section for each line of sales and organize columns for each month of year one. This statement is helpful for investors since they can use it to determine whether your business presents a good investment opportunity.

What Is Financial Reporting?

Good financial reporting gets different parties on the same page with a single version of the truth, and gives credibility to the company and its management. On the other hand, fraudulent or inaccurate financial reporting can torpedo a company’s reputation and value. Last but not least, the cash flow statement portrays how much money entered and left the business during a particular time period.

There are several initiatives to either merge the two frameworks or simply reduce their differences. Despite these distinctions, both https://bookkeeping-reviews.com/ provide a standard framework to make financial reports accurate and consistent across the board. Simply put, any financial communication, document, or information that’s shared with the public can be included in a company’s financial report. With our customizable dashboards, you can visualize all the most important data and gather it in one place. Aside from being visually pleasing, your reports will also be much more engaging and minimize any chances of error since the information will be imported directly from your financial management tools. Xero is one of the most popular accounting systems that companies use to manage their financial positions.

Monthly, quarterly or other periodic financial reports can provide an important tool to help local governments both in managing their current operating budgets and in preparing future budgets. Financial reports are required by law for tax purposes and the Internal Revenue Service uses these reports to evaluate a company’s tax income. Accurate financial reporting mitigates the risk for error and saves an immense amount of time. It relieves the overall burden that comes along with filing your company’s taxes each year.

When you work with GrowthForce, you can count on accurate and up-to-date books. Based on your company’s needs, we will enter the financial data on a weekly basis and close your books at month-end. The codification of this research, the corporate reporting framework, provides organisations with the basis to develop a comprehensive picture of their performance. This includes its market opportunities, strategies, risks, resources and other important non-financial information – precisely the type of information needed by investors. Our focus has been on aligning the interests of those who report on performance with those who use the information to make critical investment decisions.

SlideTeam has published a new blog titled ”Top 10 Projektmanagement-Workflow-Vorlagen für effiziente Unternehmen!”. Yes, you may have set some time in your calendar to spend on rounding up the numbers. But more often than not, getting the numbers means reaching out to different people and department heads and waiting on them to send over the relevant information.

Typically, this all falls under the purview of the chief financial officer, who might be involved in the presentation. The president or chief executive will likely drive the presentation of conclusions or explain strategy and address course corrections. A robust finance report communicates crucial accounting information that covers a specified period through daily, weekly, and monthly financial reports. These are powerful tools that you can apply to increase internal business performance.

For example, you can schedule your financial statement report on a daily, weekly, monthly, or yearly basis and send it to the selected recipients automatically. Moreover, you can share your dashboard or select certain viewers that have access only to the filters you have assigned. Finally, an embedded option will enable you to customize your dashboards and reports within your own application and white label based on your branding requirements. You can learn more about this point in our article where we explain in detail the usage and benefits of professional white label BI and embedded analytics.

Spend ManagementStrategic sourcing, procure-to-pay, inventory management, and expenses. Wire Transfers – This will display a copy of the Wire Transferwith accompanying documentation.Contact the Investment Management Office with questions about Wire Transfers. General Journal Entry – This will display a copy of the General Journal Entrywith accompanying documentation.Contact your friendly Cognizant Accountantfor questions about General Journal Entries. Shows the total revenue, expenses and/or transfers since the beginning of the Project through the Accounting Period specified. Shows the total revenue, expenses and/or transfers for the Accounting Period specified.